Navigating the Bi-Weekly Pay Cycle: A Comprehensive Guide to Understanding and Managing Your Finances

Related Articles: Navigating the Bi-Weekly Pay Cycle: A Comprehensive Guide to Understanding and Managing Your Finances

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Bi-Weekly Pay Cycle: A Comprehensive Guide to Understanding and Managing Your Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Bi-Weekly Pay Cycle: A Comprehensive Guide to Understanding and Managing Your Finances

The bi-weekly pay cycle, where employees receive their salaries every two weeks, is a common practice in many workplaces. While this system may seem straightforward, it can present unique challenges for managing personal finances. This article will delve into the intricacies of the bi-weekly pay structure, exploring its advantages and disadvantages, offering practical strategies for budgeting and financial planning, and addressing frequently asked questions.

Understanding the Bi-Weekly Pay Cycle

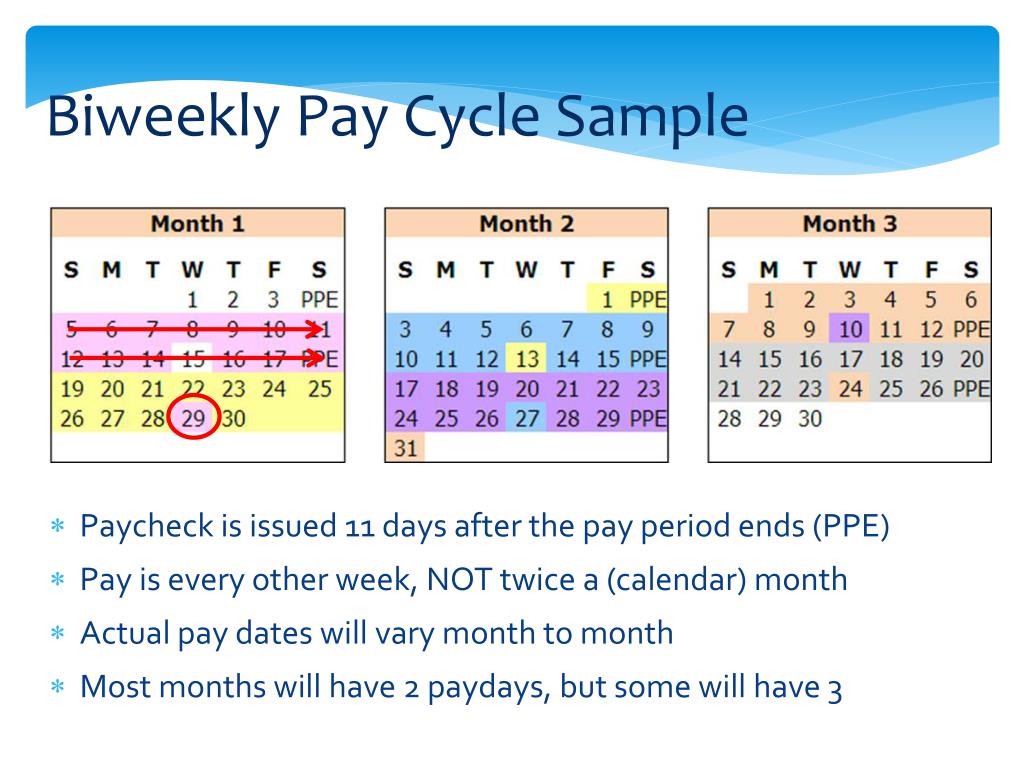

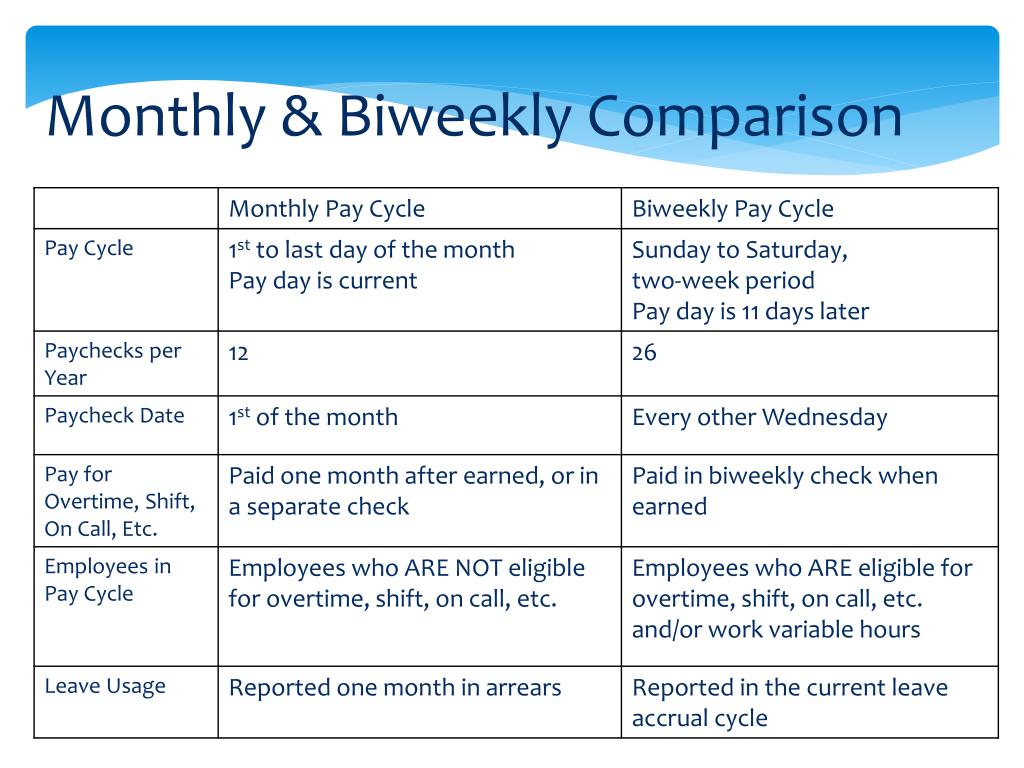

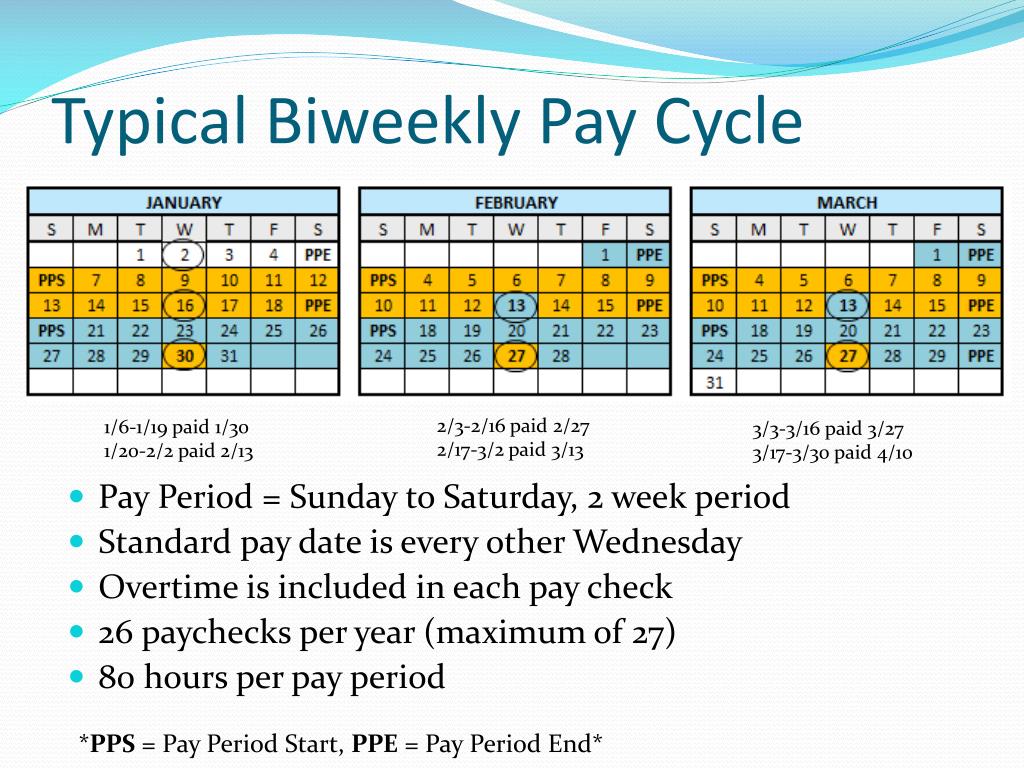

A bi-weekly pay cycle operates on a schedule where employees receive their paychecks twice a month, typically on a fixed day of the week, such as every other Friday. This system is distinct from a monthly pay cycle, where employees receive their salary once a month, usually on a specific date.

Advantages of a Bi-Weekly Pay Cycle

- Regular Income Flow: Bi-weekly payments provide a consistent and predictable income stream, allowing individuals to better manage their expenses and plan for future financial goals.

- Improved Cash Flow: The frequency of paychecks can help individuals maintain a healthier cash flow, reducing the risk of financial strain between pay periods.

- Enhanced Budgeting Control: With a bi-weekly pay schedule, budgeting becomes more manageable. Individuals can allocate their income more effectively, ensuring they have sufficient funds for essential expenses and savings goals.

Challenges of a Bi-Weekly Pay Cycle

- Budgeting Complexity: While bi-weekly payments offer more frequent income, they can also create budgeting complexities. Individuals may need to adapt their budgeting strategies to accommodate the bi-weekly cycle, ensuring they accurately track their spending and allocate funds accordingly.

- Potential for Overspending: The frequency of paychecks can sometimes lead to overspending, as individuals may feel tempted to spend more freely knowing that another paycheck is just around the corner.

- Uneven Income Distribution: The bi-weekly pay cycle can result in uneven income distribution throughout the year. For example, some months may have three paychecks, while others may have only two, leading to variations in monthly income.

Strategies for Managing a Bi-Weekly Pay Cycle

1. Budgeting and Financial Planning:

- Develop a Budget: Create a detailed budget that outlines your income and expenses. Allocate funds for essential needs, such as rent, utilities, and groceries, as well as savings goals and discretionary spending.

- Track Your Spending: Monitor your expenses closely, using a budgeting app, spreadsheet, or notebook. Regularly review your spending habits and identify areas where you can cut back.

- Automate Savings: Set up automatic transfers from your checking account to your savings account to ensure consistent contributions towards your financial goals.

2. Managing Income Fluctuations:

- Establish a Savings Buffer: Build an emergency fund that covers at least three to six months of essential expenses. This will provide a financial cushion during periods of reduced income or unexpected financial emergencies.

- Consider a Side Hustle: Explore opportunities to earn additional income through a part-time job or freelance work. This can help supplement your regular income and provide financial stability.

3. Handling Irregular Income:

- Budget for the Average: If your income fluctuates, budget based on your average income over several months. This will help you create a sustainable budget that can accommodate variations in your pay.

- Utilize Savings: Draw from your emergency fund during months with lower income to ensure you can cover your essential expenses.

Frequently Asked Questions (FAQs) about Bi-Weekly Pay Cycles

1. How do I calculate my bi-weekly pay?

To calculate your bi-weekly pay, divide your annual salary by 26 (the number of bi-weekly pay periods in a year).

2. What are the advantages of a bi-weekly pay cycle over a monthly pay cycle?

A bi-weekly pay cycle offers more frequent income, which can improve cash flow and budgeting control. It also provides a more consistent income stream, making it easier to plan for expenses and savings goals.

3. How can I avoid overspending with a bi-weekly pay cycle?

Create a detailed budget, track your expenses closely, and consider using budgeting tools to help you manage your spending.

4. What are some tips for budgeting with a bi-weekly pay cycle?

Allocate funds for essential expenses, savings goals, and discretionary spending. Consider using a budgeting app or spreadsheet to track your income and expenses.

5. What are some strategies for managing income fluctuations with a bi-weekly pay cycle?

Establish an emergency fund, explore side hustles, and budget based on your average income over several months.

Tips for Optimizing Your Bi-Weekly Pay Cycle

- Prioritize Savings: Make saving a priority by automating transfers from your checking account to your savings account.

- Negotiate Your Pay: If possible, negotiate a higher salary or request a raise to increase your income.

- Explore Financial Resources: Utilize resources such as budgeting apps, financial advisors, and credit counseling services to improve your financial management skills.

- Seek Professional Help: If you struggle with managing your finances, consider seeking professional advice from a financial advisor or credit counselor.

Conclusion

The bi-weekly pay cycle presents both advantages and challenges for managing personal finances. By understanding the intricacies of this system, developing effective budgeting strategies, and utilizing available resources, individuals can effectively manage their income and achieve their financial goals. By prioritizing savings, budgeting wisely, and seeking professional advice when needed, you can navigate the bi-weekly pay cycle with confidence and achieve financial security.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Bi-Weekly Pay Cycle: A Comprehensive Guide to Understanding and Managing Your Finances. We hope you find this article informative and beneficial. See you in our next article!