Navigating the Federal Reserve’s Rate Setting Calendar: A Guide to Understanding Monetary Policy

Related Articles: Navigating the Federal Reserve’s Rate Setting Calendar: A Guide to Understanding Monetary Policy

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Federal Reserve’s Rate Setting Calendar: A Guide to Understanding Monetary Policy. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Federal Reserve’s Rate Setting Calendar: A Guide to Understanding Monetary Policy

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Role_of_the_Fed_Jun_2020-01-02efe1c99128421195f2a3c68737d792.jpg)

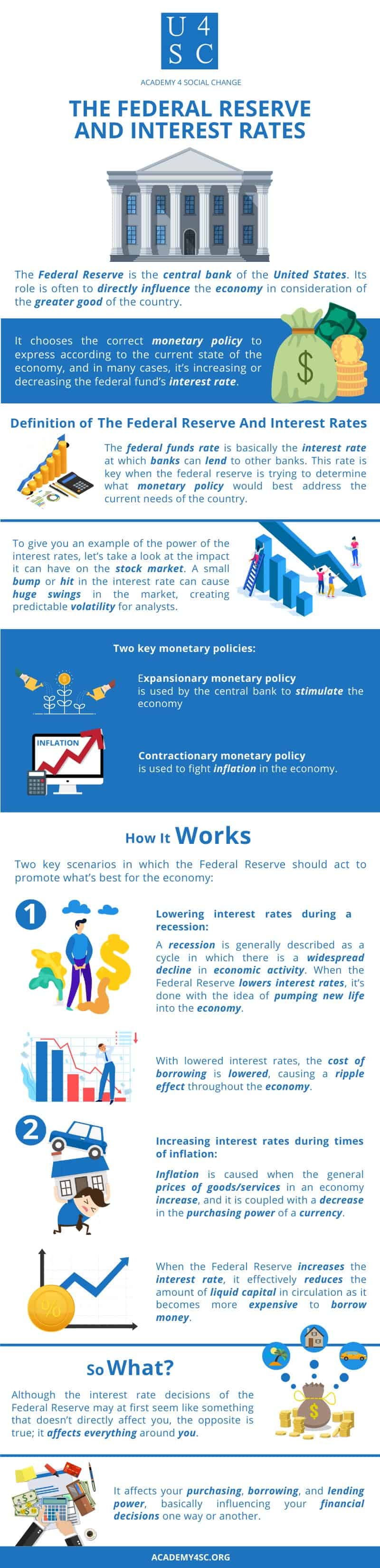

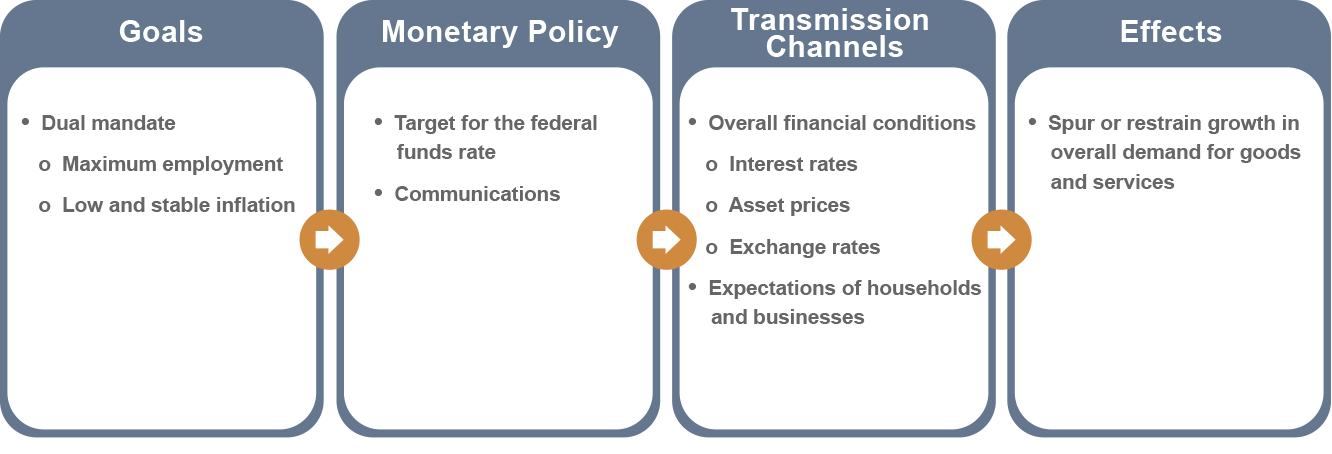

The Federal Reserve, often referred to as the Fed, is the central bank of the United States. It plays a crucial role in maintaining a stable and healthy economy by influencing interest rates and controlling the money supply. The Fed’s decisions regarding interest rates have a profound impact on various aspects of the economy, from borrowing costs for businesses and individuals to the value of the dollar. Understanding the Federal Reserve’s rate-setting calendar is essential for anyone seeking to navigate the economic landscape effectively.

The Federal Open Market Committee (FOMC): The Decision Makers

The Federal Open Market Committee (FOMC) is the body responsible for setting monetary policy in the United States. It comprises seven members of the Board of Governors and five Federal Reserve Bank presidents, rotating on a yearly basis. The FOMC meets eight times a year to discuss economic conditions and decide on appropriate monetary policy actions.

The Federal Funds Rate: The Key Interest Rate

The federal funds rate is the target interest rate that commercial banks charge each other for overnight loans. It serves as a benchmark for other interest rates in the economy. By adjusting the federal funds rate, the Fed influences the overall cost of borrowing and lending, thereby impacting economic activity.

The Rate Setting Calendar: A Roadmap for Monetary Policy

The Federal Reserve’s rate-setting calendar outlines the dates for FOMC meetings throughout the year. These meetings are crucial for understanding the Fed’s stance on monetary policy and its potential impact on the economy.

Understanding the Calendar:

- Meeting Dates: The FOMC meeting schedule is typically published in advance, providing market participants with ample time to anticipate potential policy changes.

- Statement Releases: Following each meeting, the FOMC releases a statement outlining its assessment of the economy and its policy decisions. These statements are closely scrutinized by investors and economists for clues about the Fed’s future actions.

- Press Conferences: After certain meetings, the Fed Chair holds a press conference to elaborate on the FOMC’s decisions and answer questions from reporters. These press conferences offer further insights into the Fed’s thinking and its outlook for the economy.

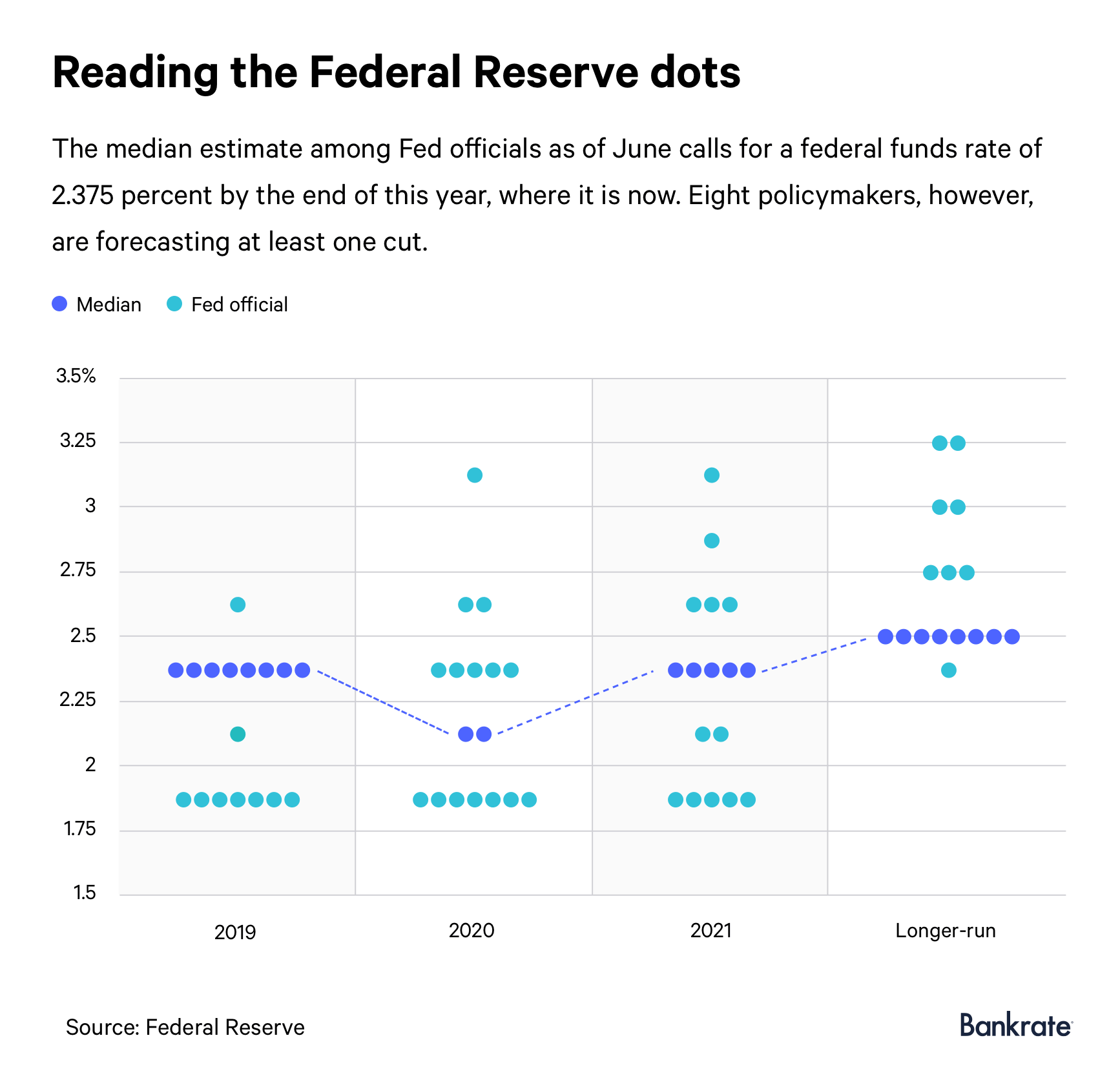

- Economic Projections: The FOMC also publishes economic projections, including estimates for inflation, unemployment, and GDP growth. These projections provide a glimpse into the Fed’s economic outlook and its expectations for future policy actions.

Benefits of Understanding the Rate Setting Calendar:

- Informed Decision Making: The rate-setting calendar provides a framework for understanding the Fed’s policy actions and their potential impact on the economy. This knowledge can inform investment decisions, business strategies, and financial planning.

- Market Volatility Mitigation: Anticipating potential policy changes through the rate-setting calendar can help mitigate market volatility. Investors and businesses can adjust their strategies based on the Fed’s anticipated actions.

- Economic Outlook Clarity: The Fed’s economic projections and statements offer insights into the economic outlook and provide a basis for forecasting future economic conditions.

- Policy Transparency: The rate-setting calendar and accompanying publications enhance transparency in monetary policymaking, fostering trust and confidence in the Fed’s actions.

FAQs Regarding the Federal Reserve’s Rate Setting Calendar:

1. How often does the Fed meet to set interest rates?

The FOMC meets eight times a year to discuss and set monetary policy.

2. What is the purpose of the Federal Reserve’s rate-setting calendar?

The calendar provides a clear roadmap for the Fed’s policy decisions, allowing market participants to anticipate potential changes and adjust their strategies accordingly.

3. What are the key elements of the rate-setting calendar?

The key elements include meeting dates, statement releases, press conferences, and economic projections.

4. How do the Fed’s rate decisions impact the economy?

By adjusting interest rates, the Fed influences the cost of borrowing and lending, impacting investment, consumer spending, and overall economic activity.

5. Where can I find the Federal Reserve’s rate-setting calendar?

The Federal Reserve’s website provides a comprehensive calendar of FOMC meetings and related publications.

Tips for Utilizing the Rate-Setting Calendar:

- Stay Informed: Regularly check the Federal Reserve’s website for updates on meeting schedules, statements, and economic projections.

- Analyze Statements: Carefully read the FOMC statements and pay attention to the language used to gauge the Fed’s stance on monetary policy.

- Attend Press Conferences: Watch the Fed Chair’s press conferences to gain further insights into the FOMC’s decisions and their rationale.

- Consider Economic Projections: Use the Fed’s economic projections as a benchmark for forecasting future economic conditions.

- Consult Experts: Seek advice from financial professionals and economists to interpret the Fed’s actions and their potential impact on your specific situation.

Conclusion:

The Federal Reserve’s rate-setting calendar is a valuable tool for understanding and navigating the complexities of monetary policy. By understanding the calendar’s key elements and their implications, individuals and businesses can make informed decisions and mitigate potential risks associated with economic fluctuations. Staying informed about the Fed’s actions and its economic outlook is crucial for navigating the financial landscape effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Federal Reserve’s Rate Setting Calendar: A Guide to Understanding Monetary Policy. We hope you find this article informative and beneficial. See you in our next article!