Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates

Related Articles: Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates

In the ever-evolving landscape of business, staying ahead of the curve is paramount. This is especially true when it comes to managing payroll, a critical function that directly impacts employee satisfaction and financial stability. As we approach 2025, understanding the significance of a well-structured payroll calendar becomes more crucial than ever. This comprehensive guide delves into the intricacies of 2025 payroll calendar templates, exploring their benefits, considerations, and best practices.

Understanding the Foundation: What is a Payroll Calendar Template?

A payroll calendar template serves as a vital roadmap for managing payroll processes throughout the year. It outlines key dates for payroll processing, including:

- Pay Dates: The specific days on which employees receive their salaries or wages.

- Payroll Cut-Off Dates: The deadlines for submitting time and attendance records for payroll calculation.

- Tax Filing Deadlines: Important dates for remitting taxes to relevant authorities.

- Holiday Adjustments: Modifications to pay cycles due to public holidays or company closures.

The Importance of a 2025 Payroll Calendar Template

While the fundamental principles of payroll remain consistent, the year 2025 presents several factors that underscore the importance of a robust payroll calendar template:

- Evolving Legal Landscape: Labor laws and tax regulations are subject to change. A 2025 payroll calendar template ensures compliance with the latest updates, minimizing the risk of penalties and legal issues.

- Technological Advancements: The integration of automation and artificial intelligence (AI) in payroll systems is accelerating. A well-designed template can optimize these technologies, streamlining processes and enhancing efficiency.

- Global Workforce: Businesses with employees in multiple locations must consider diverse payroll regulations and time zones. A comprehensive calendar template helps manage these complexities effectively.

- Employee Satisfaction: Accurate and timely payroll processing is crucial for employee morale and retention. A dedicated calendar template ensures a smooth and predictable payroll cycle, fostering a positive work environment.

Key Components of a 2025 Payroll Calendar Template

To effectively navigate the complexities of 2025 payroll, a comprehensive calendar template should incorporate the following elements:

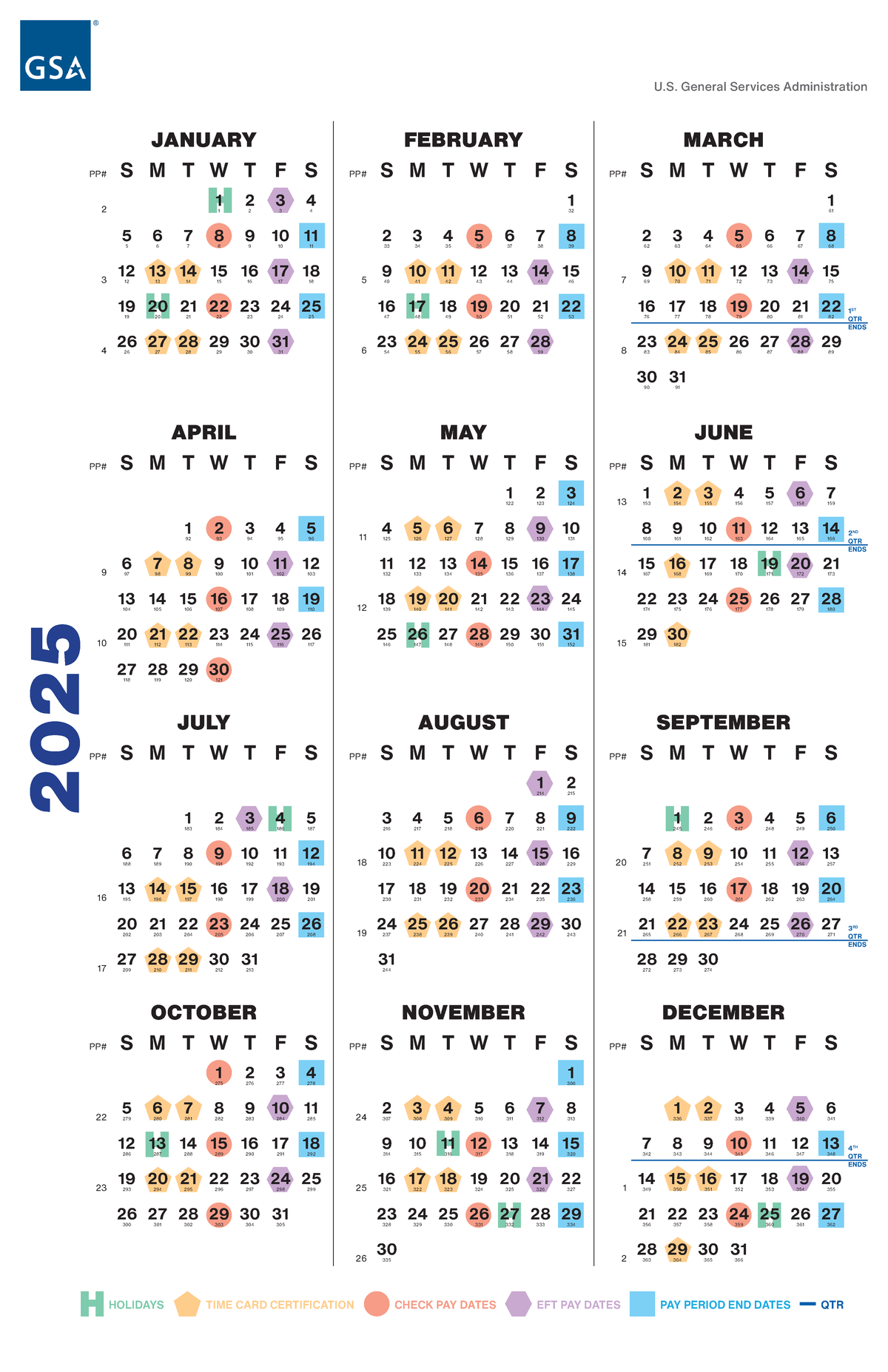

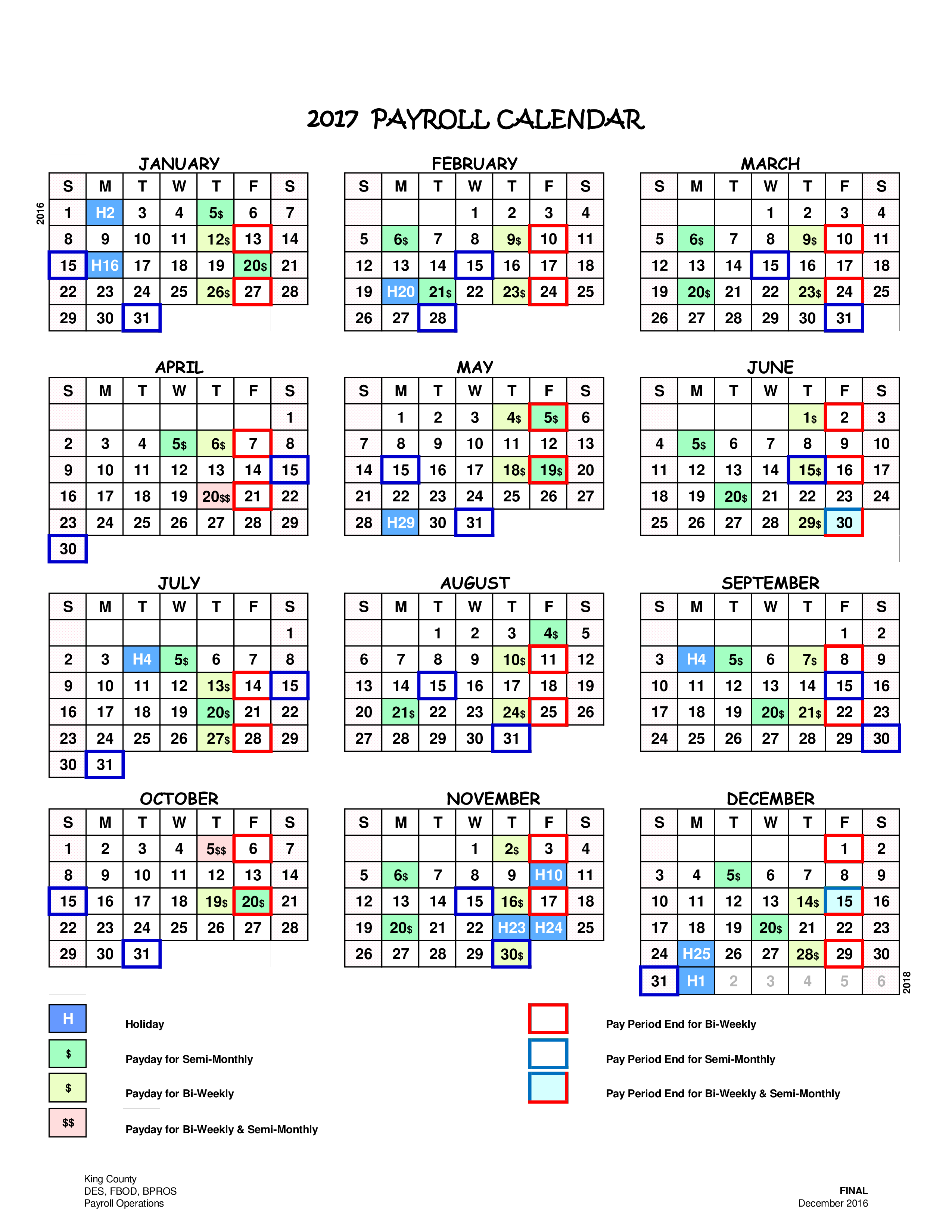

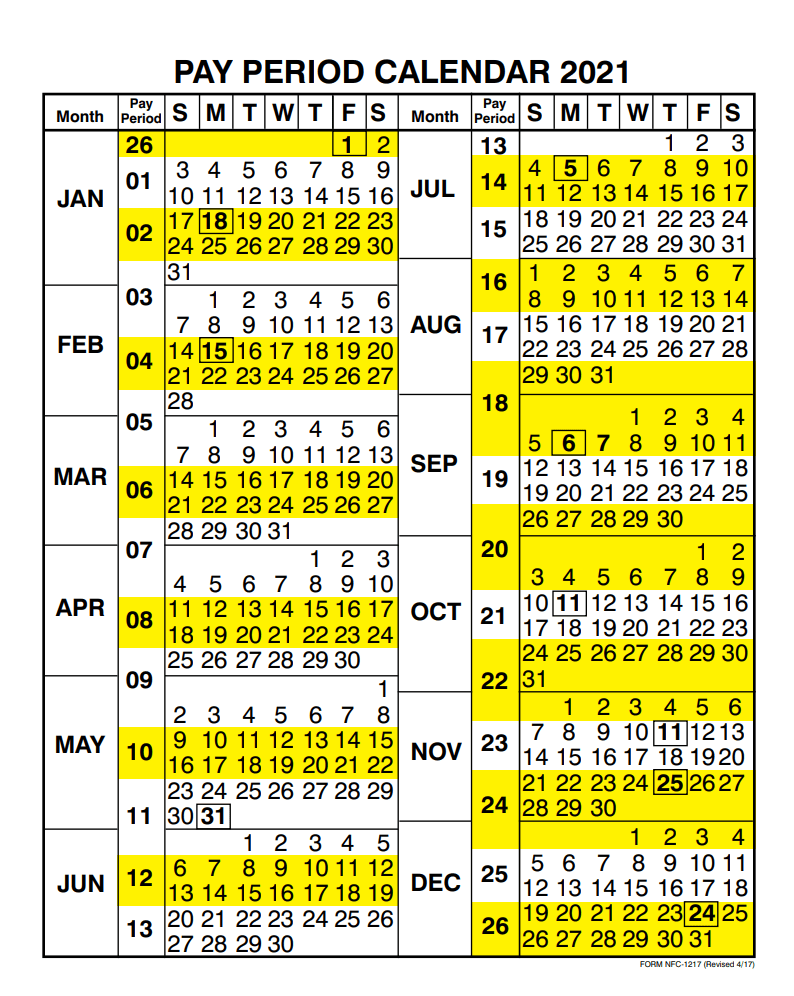

- Pay Frequency: Define the regularity of payroll processing, whether it’s weekly, bi-weekly, semi-monthly, or monthly.

- Holiday Schedule: Include all relevant public holidays and company closures, factoring in their impact on pay dates and payroll deadlines.

- Tax Filing Dates: Specify the deadlines for federal, state, and local tax filings, including quarterly and annual submissions.

- Payroll Cut-Off Times: Clearly establish the time by which employees must submit their time and attendance records for payroll calculation.

- Leave Accrual and Deductions: Outline the accrual rates for paid time off (PTO), sick leave, and other benefits, along with any applicable deductions.

- Employee Data Management: Include provisions for tracking employee changes, such as new hires, terminations, and salary adjustments.

- Reporting and Analytics: Integrate features for generating reports on payroll expenses, tax liabilities, and employee compensation trends.

Benefits of Utilizing a 2025 Payroll Calendar Template

Implementing a well-structured 2025 payroll calendar template brings numerous benefits to businesses:

- Enhanced Accuracy and Efficiency: By streamlining payroll processes, the template minimizes errors and ensures timely payment of salaries and wages.

- Improved Compliance: The calendar acts as a central repository for legal requirements, ensuring compliance with evolving labor laws and tax regulations.

- Increased Transparency: A clear and organized calendar fosters transparency in payroll operations, building trust and accountability.

- Reduced Administrative Burden: Automating repetitive tasks through the calendar frees up human resources for more strategic initiatives.

- Cost Savings: By minimizing errors and optimizing payroll processes, the template helps reduce administrative costs and improve overall financial efficiency.

FAQs Regarding 2025 Payroll Calendar Templates

Q: What software options are available for creating and managing 2025 payroll calendar templates?

A: Several software solutions cater to payroll calendar management, including:

- Spreadsheet Software: Excel and Google Sheets offer basic template creation capabilities.

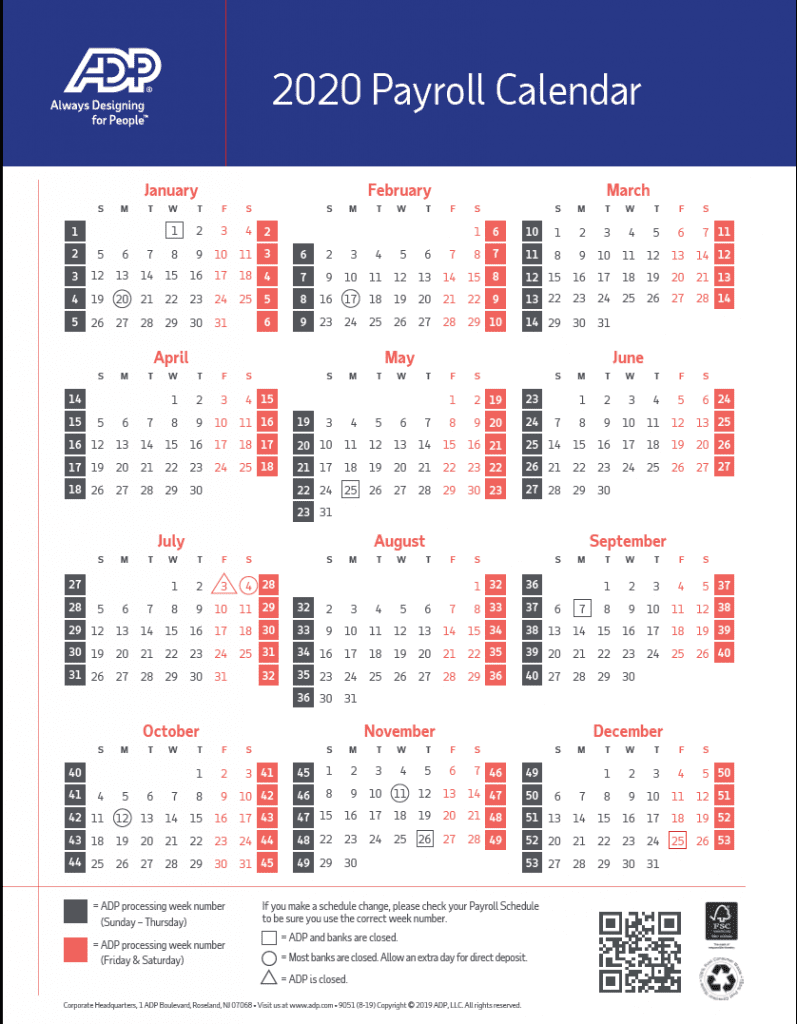

- Payroll Software: Dedicated payroll software like ADP, Paychex, and Gusto typically include calendar features.

- Project Management Tools: Tools like Asana, Trello, and Monday.com can be used to create and manage payroll schedules.

Q: How frequently should a 2025 payroll calendar template be reviewed and updated?

A: The frequency of review and updates depends on factors like business size, payroll complexity, and regulatory changes. A general recommendation is to review the calendar at least annually, or more frequently if significant changes occur.

Q: Can a 2025 payroll calendar template be customized to suit specific business needs?

A: Yes, a 2025 payroll calendar template should be customized to reflect the unique requirements of each business. This includes factors like payroll frequency, pay dates, holiday schedules, and applicable tax regulations.

Q: What are some best practices for creating a 2025 payroll calendar template?

A: Here are some key best practices for creating an effective 2025 payroll calendar template:

- Start Early: Begin planning and creating the template well in advance of the new year to allow for sufficient time for adjustments and implementation.

- Consult with Experts: Seek guidance from payroll professionals or legal advisors to ensure compliance with relevant regulations.

- Use Clear and Concise Language: Ensure the calendar is easy to understand and navigate for all stakeholders.

- Integrate with Existing Systems: Link the calendar with other payroll systems and databases for seamless data flow.

- Regularly Review and Update: Make periodic adjustments to the calendar based on changes in business operations, legal requirements, and employee needs.

Tips for Effective Utilization of a 2025 Payroll Calendar Template

- Communicate Clearly: Share the calendar with all relevant employees and stakeholders, including HR, payroll administrators, and managers.

- Utilize Reminders: Set up reminders or alerts for upcoming payroll deadlines, tax filings, and other important dates.

- Track Changes: Maintain a record of any modifications made to the calendar to ensure accuracy and consistency.

- Seek Feedback: Encourage feedback from employees and stakeholders to continuously improve the calendar’s usability and effectiveness.

Conclusion: Embracing the Future of Payroll Management

In the dynamic business environment of 2025, a robust payroll calendar template becomes an indispensable tool for navigating the complexities of payroll management. By embracing the principles of accuracy, efficiency, and compliance, businesses can leverage a well-structured template to optimize payroll processes, enhance employee satisfaction, and foster a strong financial foundation for future growth. As technology continues to evolve and regulatory landscapes shift, a proactive approach to payroll calendar management ensures businesses stay ahead of the curve, navigating the future of payroll with confidence and success.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates. We thank you for taking the time to read this article. See you in our next article!