Navigating the Market: A Guide to the Best Earnings Calendars

Related Articles: Navigating the Market: A Guide to the Best Earnings Calendars

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Market: A Guide to the Best Earnings Calendars. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Market: A Guide to the Best Earnings Calendars

The stock market, a dynamic and ever-evolving landscape, thrives on information. Understanding the financial health of publicly traded companies is paramount for investors, and one of the most crucial pieces of this puzzle is the earnings calendar. This calendar, a meticulously curated schedule of when companies release their financial reports, serves as a vital tool for investors seeking to make informed decisions.

What is an Earnings Calendar?

An earnings calendar is a comprehensive schedule that outlines the dates and times when publicly traded companies are expected to announce their financial performance. These reports, typically released quarterly, encompass a company’s revenue, earnings per share, and other key financial metrics. They provide a snapshot of the company’s current financial standing and future prospects, offering invaluable insights into its performance and potential growth.

The Importance of an Earnings Calendar:

The earnings calendar plays a pivotal role in the investment landscape, acting as a beacon for investors seeking to navigate the market effectively. Here’s why it’s crucial:

- Informed Decision-Making: Earnings reports offer crucial data points that inform investment decisions. By understanding a company’s financial performance, investors can assess its valuation, growth potential, and overall attractiveness as an investment opportunity.

- Market Volatility: Earnings releases often trigger significant market volatility. Knowing when these releases are scheduled allows investors to anticipate potential price fluctuations and adjust their strategies accordingly.

- Trend Identification: Earnings reports can provide insights into broader industry trends. By analyzing the performance of several companies within a sector, investors can gauge the overall health and future prospects of that industry.

- Competitive Analysis: Comparing earnings reports from different companies within the same sector allows investors to assess their relative performance and identify potential outperformers.

- Strategic Planning: The earnings calendar helps investors plan their trading activities, allowing them to allocate resources and focus their attention on key events and opportunities.

Choosing the Best Earnings Calendar:

Navigating the plethora of available earnings calendars can be challenging. To select the best option, consider the following factors:

- Accuracy and Reliability: Ensure the calendar provides accurate and up-to-date information, reflecting the latest changes in release dates and times.

- Comprehensiveness: The ideal calendar should encompass a wide range of companies across various sectors and market capitalizations.

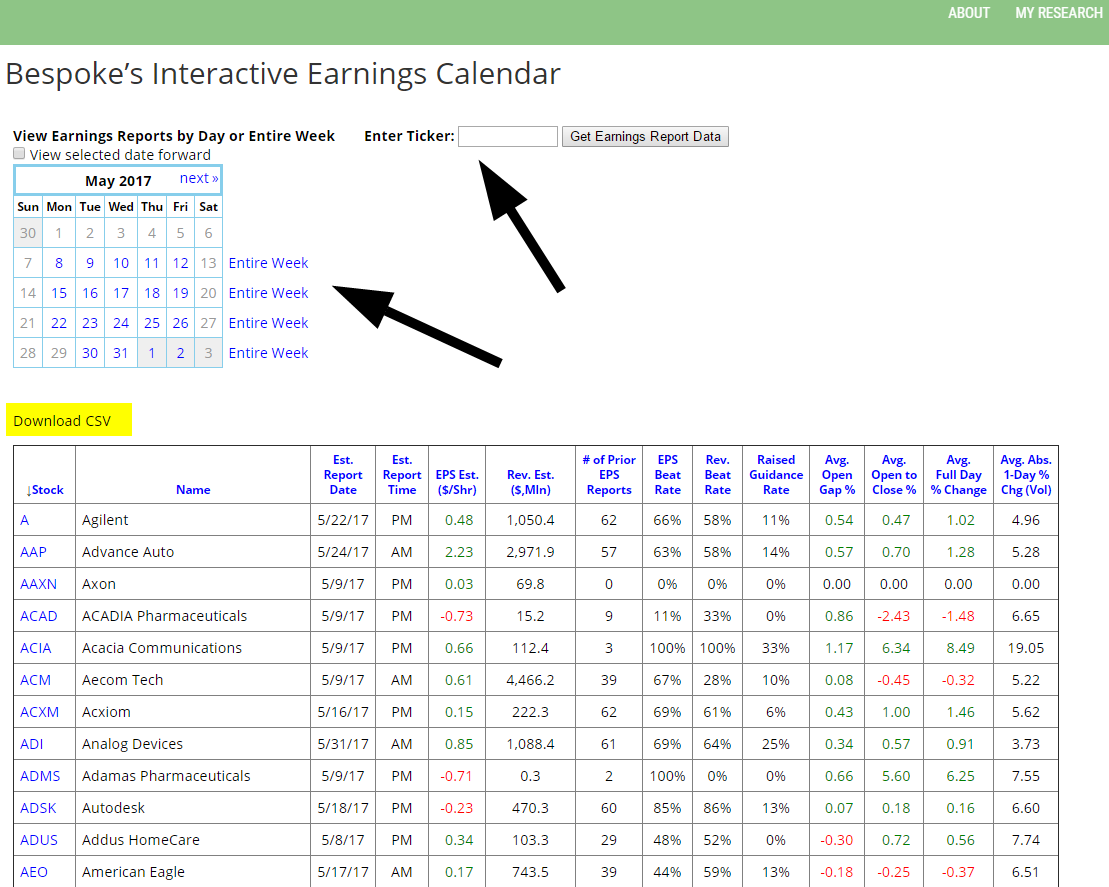

- User-Friendliness: Choose a calendar with a clear and intuitive interface, allowing for easy navigation and access to relevant data.

- Customization Options: Look for features that allow users to personalize their calendars, filtering by specific companies, sectors, or dates.

- Additional Features: Some calendars offer supplementary features such as news feeds, analyst ratings, and historical earnings data, enhancing the overall user experience.

Best Earnings Calendars in the Market:

Several reputable websites and platforms offer comprehensive earnings calendars. Here are some of the most popular and widely used options:

- Seeking Alpha: Known for its extensive coverage of financial news and analysis, Seeking Alpha provides a detailed earnings calendar with a user-friendly interface and customizable options.

- MarketBeat: This platform offers a comprehensive earnings calendar with a focus on providing real-time updates and insightful commentary on earnings releases.

- Yahoo Finance: A widely recognized financial portal, Yahoo Finance provides a user-friendly earnings calendar with additional features such as stock quotes, charts, and news feeds.

- Google Finance: This platform offers a simple and straightforward earnings calendar, allowing users to easily track earnings releases for specific companies or sectors.

- Bloomberg: A leading financial data provider, Bloomberg offers a comprehensive earnings calendar with advanced features for professional investors.

- Nasdaq: The Nasdaq Stock Market provides an earnings calendar specifically focused on Nasdaq-listed companies, offering detailed information and real-time updates.

FAQs about Earnings Calendars:

Q: How often are earnings reports released?

A: Publicly traded companies typically release their earnings reports quarterly, covering the previous three-month period. However, some companies may release reports more frequently, such as monthly or bi-monthly, depending on their industry and reporting practices.

Q: What information is included in an earnings report?

A: Earnings reports typically include key financial metrics such as revenue, net income, earnings per share, and cash flow. They may also provide insights into the company’s future outlook, operational performance, and key growth drivers.

Q: How can I find the earnings calendar for a specific company?

A: Most financial websites and platforms, including those listed above, allow users to search for specific companies and view their upcoming earnings release dates. Additionally, you can find this information on the company’s investor relations website.

Q: What is the significance of earnings per share (EPS)?

A: EPS is a crucial metric that represents the amount of profit earned per share of outstanding stock. It’s a key indicator of a company’s profitability and is often used by analysts to assess its valuation and growth potential.

Q: How can I interpret earnings reports?

A: Analyzing earnings reports requires understanding the company’s business model, industry dynamics, and financial statements. It’s essential to compare the current report with previous periods, industry averages, and analyst expectations to gain a comprehensive understanding of the company’s performance.

Tips for Using an Earnings Calendar:

- Stay organized: Create a personalized calendar to track upcoming earnings releases for companies you are interested in or have invested in.

- Monitor market trends: Pay attention to broader market trends and how they might influence company performance and earnings releases.

- Read the fine print: Carefully review the earnings reports, paying attention to any non-GAAP adjustments or unusual items that might impact the company’s financial performance.

- Seek professional advice: Consult with a financial advisor or investment professional for guidance on interpreting earnings reports and making informed investment decisions.

Conclusion:

The earnings calendar is an indispensable tool for investors seeking to navigate the complexities of the stock market. By understanding the importance of earnings reports, choosing the best calendar, and utilizing it effectively, investors can gain valuable insights into company performance, market trends, and potential investment opportunities. Remember, staying informed and leveraging the power of the earnings calendar is a crucial step towards achieving your investment goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Market: A Guide to the Best Earnings Calendars. We thank you for taking the time to read this article. See you in our next article!