The Forex Trading Calendar: Your Guide to Navigating Market Volatility

Related Articles: The Forex Trading Calendar: Your Guide to Navigating Market Volatility

Introduction

With great pleasure, we will explore the intriguing topic related to The Forex Trading Calendar: Your Guide to Navigating Market Volatility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Forex Trading Calendar: Your Guide to Navigating Market Volatility

The foreign exchange (forex) market, the world’s largest and most liquid financial market, operates 24 hours a day, five days a week. This constant flow of activity makes it a dynamic and potentially lucrative environment for traders. However, navigating this complex market requires a keen understanding of the factors that drive currency movements. One crucial tool for forex traders is the economic calendar.

Understanding the Economic Calendar: A Window into Market Sentiment

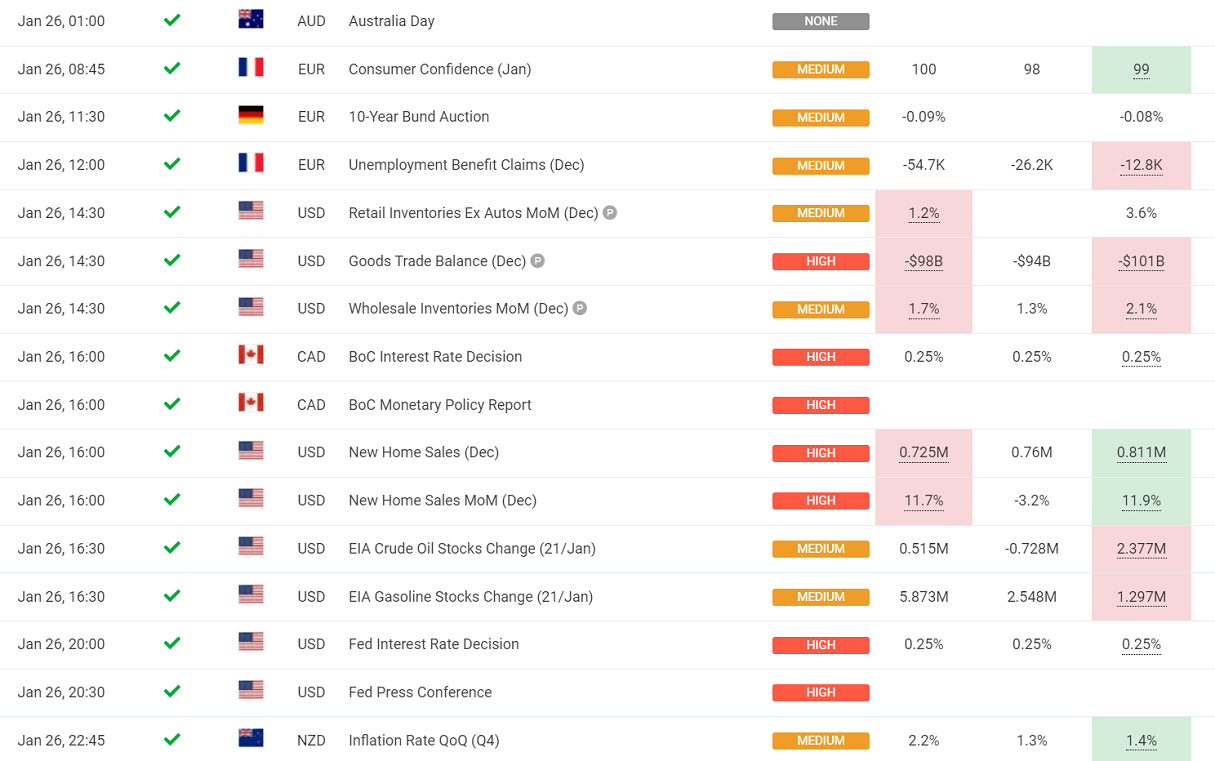

The economic calendar is a comprehensive resource that lists upcoming economic events and releases, along with their potential impact on currency markets. These events, ranging from interest rate decisions by central banks to employment data releases, provide valuable insights into the health of an economy and its currency.

Key Economic Events to Watch

The economic calendar is populated with a variety of data points, each carrying its own significance. Here are some of the most influential events:

- Central Bank Interest Rate Decisions: These announcements are closely watched by traders as they reflect the central bank’s stance on monetary policy. Higher interest rates generally attract foreign investment, strengthening the currency.

- Inflation Data (CPI, PPI): Consumer Price Index (CPI) and Producer Price Index (PPI) measure the rate of price changes in consumer goods and producer goods, respectively. High inflation can lead to a weakening currency as purchasing power decreases.

- Employment Data (Unemployment Rate, Non-Farm Payrolls): Employment data provides insights into the labor market’s health. Strong employment figures typically boost a currency, while weak numbers can have the opposite effect.

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country. Strong GDP growth indicates a healthy economy and can strengthen the currency.

- Trade Balance: The trade balance reflects the difference between a country’s exports and imports. A positive trade balance (more exports than imports) can strengthen the currency.

- Manufacturing and Services Purchasing Managers’ Index (PMI): PMIs gauge the health of the manufacturing and services sectors. Strong PMIs suggest economic growth and can support a currency.

The Impact of Economic Events on Forex Trading

The economic calendar is not simply a list of dates and numbers. It provides crucial information about the potential impact of these events on currency markets.

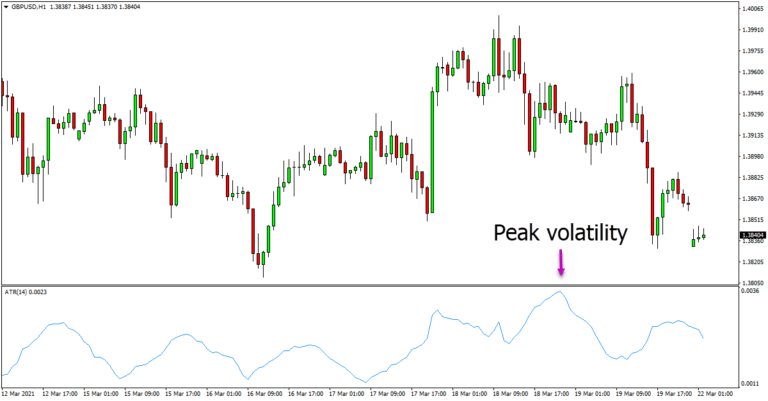

- Market Volatility: Economic releases can trigger significant price fluctuations in currency pairs. Understanding the potential impact of an event allows traders to adjust their strategies accordingly.

- Trading Opportunities: Economic events can create opportunities for traders to profit from price movements. By anticipating the direction of a currency after an event, traders can enter trades with a higher probability of success.

- Risk Management: The economic calendar helps traders assess the risk associated with specific trades. Knowing the potential for volatility allows traders to set appropriate stop-loss orders and manage their positions effectively.

Interpreting the Economic Calendar: Key Considerations

While the economic calendar is a valuable tool, it’s essential to interpret its information with caution.

- Consensus Expectations: The economic calendar often includes consensus forecasts for economic indicators. These forecasts represent the average expectation of economists. A significant deviation from these forecasts can lead to unexpected market reactions.

- Previous Releases: It’s crucial to consider the trend of previous economic releases. A single data point may not be indicative of a long-term trend.

- Geopolitical Factors: Geopolitical events, such as political instability or trade disputes, can also influence currency markets. The economic calendar may not always capture these external factors.

Tips for Utilizing the Economic Calendar

- Stay Organized: Create a schedule of upcoming economic releases and set reminders to avoid missing crucial events.

- Prioritize Events: Focus on events that have a significant impact on the currency pairs you trade.

- Analyze Data: Compare actual releases with consensus forecasts and previous data to understand the potential market impact.

- Adapt Your Strategy: Adjust your trading strategies based on the economic calendar’s information.

- Manage Risk: Use appropriate stop-loss orders and risk management techniques to mitigate losses during periods of high volatility.

FAQs About the Forex Trading Calendar

1. Where can I find a reliable Forex trading calendar?

Numerous websites and financial platforms provide comprehensive economic calendars. Some popular options include:

- Investing.com: Offers a detailed calendar with various filters and data points.

- FXStreet: Provides a user-friendly calendar with real-time updates and analysis.

- DailyFX: Offers a calendar with a focus on technical analysis and market commentary.

- TradingView: Integrates an economic calendar with its charting platform.

2. How often is the Forex trading calendar updated?

The economic calendar is continuously updated with new releases and revisions. Most websites and platforms offer real-time updates to ensure traders have access to the latest information.

3. What are the different types of economic releases on the calendar?

The economic calendar includes a wide range of data points, categorized into:

- Central Bank Announcements: Interest rate decisions, monetary policy statements.

- Economic Indicators: GDP, inflation data, employment figures, trade balance.

- Business Confidence Surveys: PMIs, consumer sentiment indices.

- Government Reports: Budget announcements, policy updates.

4. How can I use the Forex trading calendar to my advantage?

- Anticipate Volatility: Identify upcoming events that could trigger significant price fluctuations.

- Identify Trading Opportunities: Recognize potential trading setups based on anticipated market reactions.

- Manage Risk: Set appropriate stop-loss orders and adjust position sizes based on the potential for volatility.

5. What are the limitations of the Forex trading calendar?

- Not a Crystal Ball: The calendar provides information about potential market reactions, but it does not guarantee specific price movements.

- Geopolitical Factors: The calendar may not capture all external factors that can influence currency markets.

- Market Sentiment: The market’s reaction to an economic release can be influenced by factors beyond the data itself.

Conclusion: The Importance of the Forex Trading Calendar

The economic calendar is an indispensable tool for forex traders, providing insights into the factors that drive currency movements. By understanding the potential impact of upcoming economic events, traders can navigate the market with greater confidence, identify trading opportunities, and manage risk effectively. While the calendar does not provide guarantees, it offers valuable information that can enhance trading decisions and improve overall performance in the dynamic world of forex trading.

Closure

Thus, we hope this article has provided valuable insights into The Forex Trading Calendar: Your Guide to Navigating Market Volatility. We appreciate your attention to our article. See you in our next article!