Unlocking Rewards: A Comprehensive Guide to American Express Cash Back Calendars

Related Articles: Unlocking Rewards: A Comprehensive Guide to American Express Cash Back Calendars

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking Rewards: A Comprehensive Guide to American Express Cash Back Calendars. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking Rewards: A Comprehensive Guide to American Express Cash Back Calendars

![American Express Membership Rewards - The Ultimate Guide [2020]](https://upgradedpoints.com/wp-content/uploads/2016/04/Amex_Cash_Back_Summary-1041x500.png)

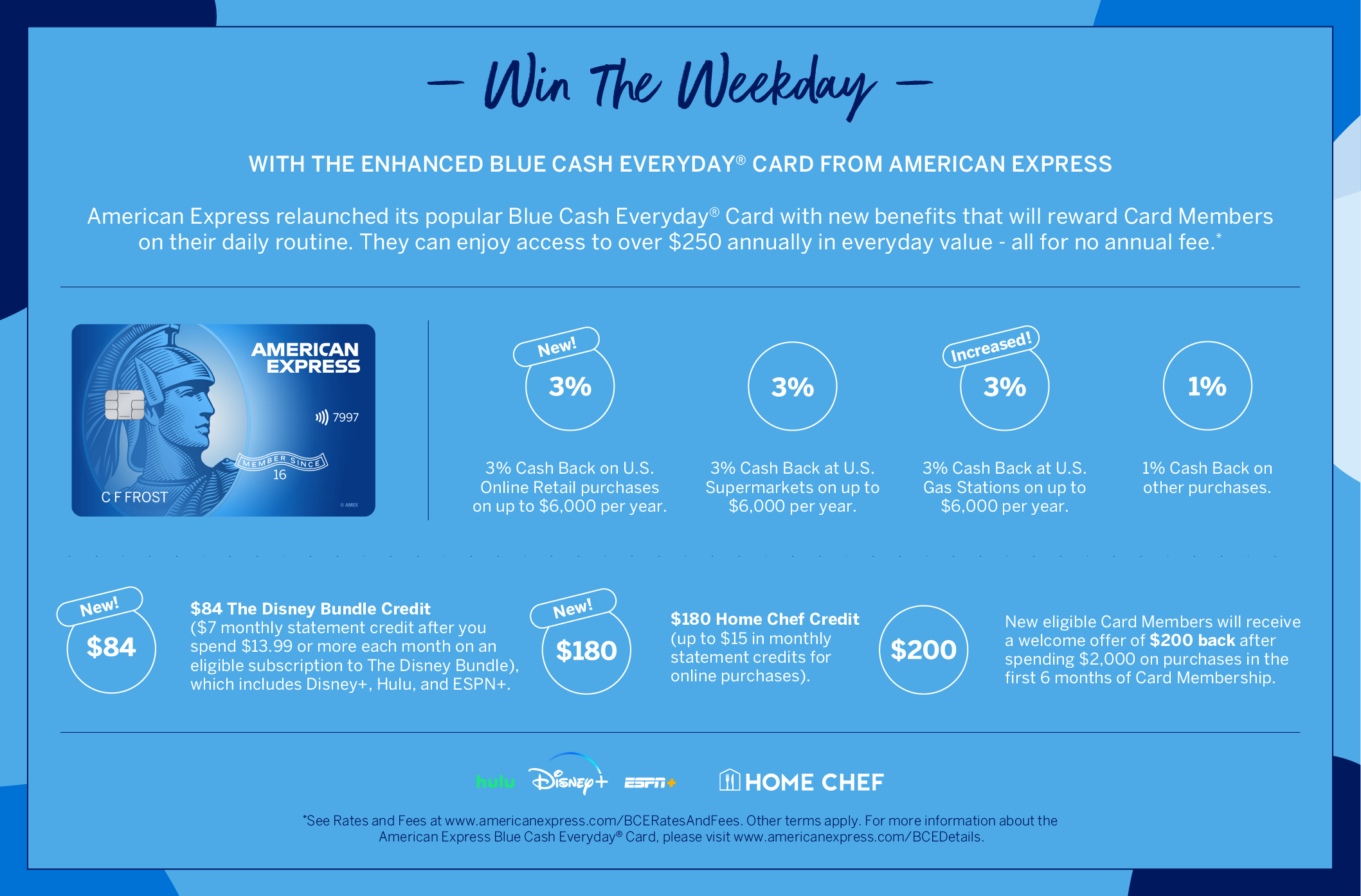

American Express, a global financial services giant, is renowned for its diverse portfolio of credit cards, each offering a unique set of benefits and rewards. Among these, the American Express Cash Back Calendar stands out as a particularly enticing feature for cardholders seeking to maximize their earnings potential.

This article delves into the intricacies of the American Express Cash Back Calendar, providing a comprehensive understanding of its mechanics, benefits, and practical applications. We will explore how this feature empowers cardholders to earn more cash back on their everyday purchases, making it a valuable tool for savvy consumers.

Understanding the American Express Cash Back Calendar

The American Express Cash Back Calendar is a dynamic program that offers enhanced cash back rewards on specific categories of purchases throughout the year. Each month, American Express designates a particular category of goods or services, allowing cardholders to earn a higher percentage of cash back on eligible purchases within that category.

How the American Express Cash Back Calendar Works:

-

Monthly Category Selection: American Express selects a new category each month, typically aligning with seasonal trends or popular consumer spending patterns. These categories can range from dining and travel to electronics and home goods.

-

Elevated Cash Back Rate: The designated category for the month enjoys a boosted cash back rate, often exceeding the standard cash back percentage offered by the card. This elevated rate can be significantly higher, making it an attractive incentive for cardholders to strategically plan their purchases.

-

Eligible Purchases: The program typically includes purchases made at participating merchants within the designated category. American Express clearly outlines the eligible merchants and transaction types to ensure transparency and clarity for cardholders.

-

Tracking Progress: Cardholders can conveniently track their progress and monitor their cash back earnings through their online account or mobile app. This feature allows for easy oversight of rewards accumulated throughout the month.

Benefits of the American Express Cash Back Calendar:

-

Enhanced Cash Back Earnings: The most prominent benefit is the opportunity to earn significantly higher cash back on specific categories of purchases, boosting overall rewards potential.

-

Flexibility and Adaptability: The monthly rotation of categories allows cardholders to tailor their spending to maximize their earnings. This flexibility enables strategic planning based on individual needs and preferences.

-

Seasonal Advantage: The program often aligns with seasonal trends, offering enhanced rewards on popular categories during peak seasons, such as holiday shopping or summer travel.

-

Convenient Tracking: The online account and mobile app provide a user-friendly interface for tracking progress and monitoring earned rewards.

Maximizing the American Express Cash Back Calendar:

-

Plan Your Purchases: Review the monthly category selection and align your spending with the designated category to maximize cash back earnings.

-

Utilize the Calendar: Stay informed about the upcoming categories by regularly checking the American Express Cash Back Calendar. This allows for strategic planning and optimization of spending.

-

Shop at Participating Merchants: Ensure that your purchases are made at eligible merchants to qualify for the elevated cash back rate.

-

Combine with Other Rewards: Consider using the card in conjunction with other American Express offers, such as bonus points or airline miles, to further enhance rewards.

FAQs about the American Express Cash Back Calendar:

Q: How do I enroll in the American Express Cash Back Calendar program?

A: Enrollment is automatic for all eligible American Express cardholders. No additional registration or sign-up is required.

Q: What is the standard cash back rate for my American Express card?

A: The standard cash back rate varies depending on the specific card you hold. Refer to your card agreement or visit the American Express website for detailed information.

Q: How often does the designated category change?

A: The category changes on a monthly basis, with a new selection announced at the beginning of each month.

Q: Are there any restrictions or limitations on the amount of cash back I can earn?

A: The program may have specific terms and conditions regarding the maximum amount of cash back earned within a designated category. Consult your card agreement for detailed information.

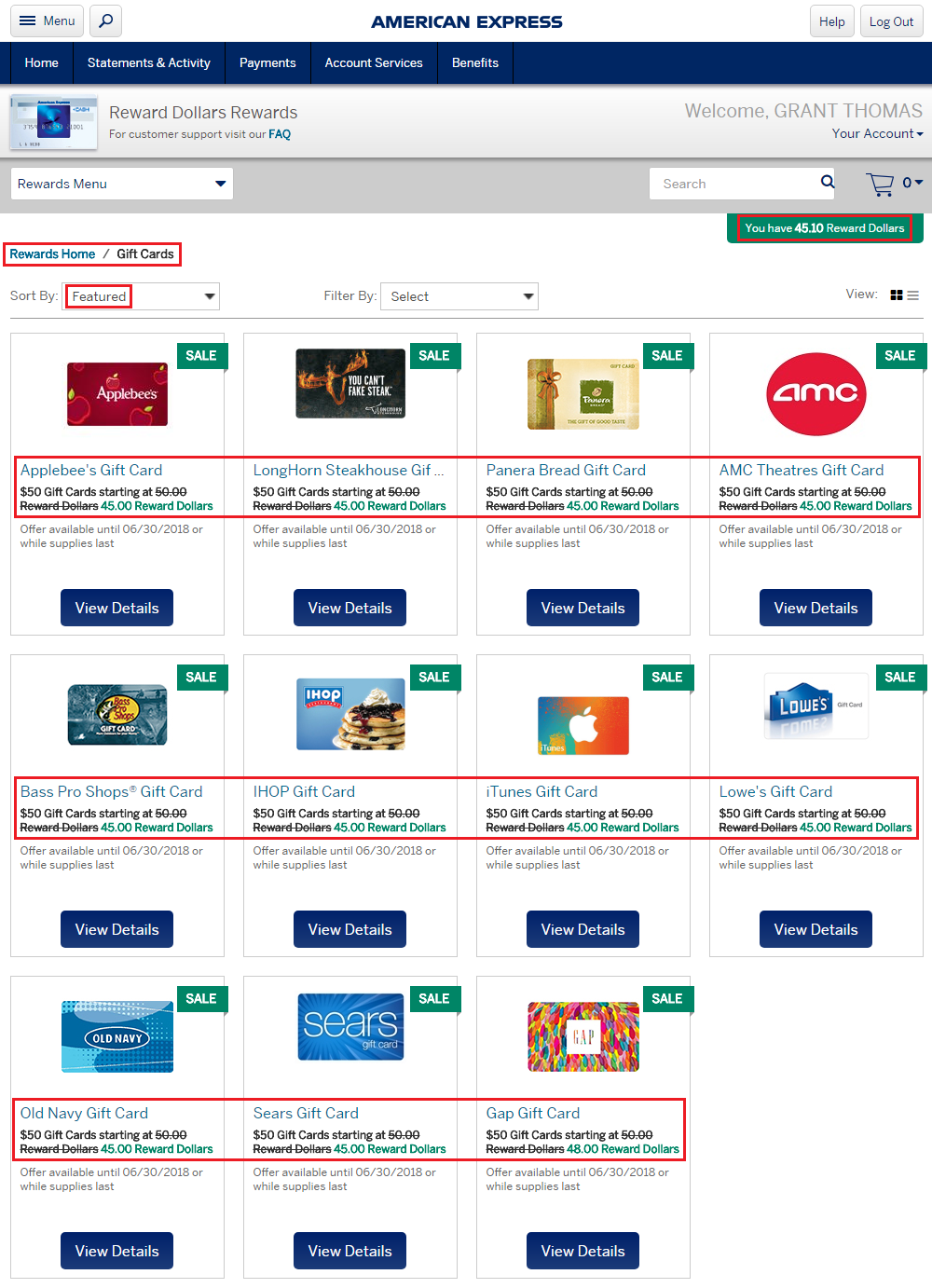

Q: How do I redeem my earned cash back?

A: Cash back rewards can typically be redeemed as statement credits, gift cards, or deposited into your bank account. The redemption options may vary based on the specific card and its associated terms.

Tips for Optimizing Cash Back Earnings:

-

Set a Budget: Allocate a specific amount for monthly spending within the designated category to ensure responsible financial management.

-

Track Your Spending: Monitor your spending within the chosen category to ensure you are maximizing the elevated cash back rate.

-

Consider Combining Purchases: If possible, group purchases within the designated category to maximize your cash back earnings on a single transaction.

-

Explore Targeted Offers: American Express often provides additional targeted offers and promotions, which can further enhance cash back rewards.

Conclusion

The American Express Cash Back Calendar is a valuable tool for cardholders seeking to maximize their rewards potential. By strategically planning purchases and taking advantage of the monthly category rotations, cardholders can earn significantly higher cash back on their everyday spending. The program’s flexibility, ease of use, and potential for substantial rewards make it a compelling feature for savvy consumers looking to optimize their financial benefits.

![American Express Membership Rewards - The Ultimate Guide [2020]](https://upgradedpoints.com/wp-content/uploads/2016/04/Amex_Cash_Back_Card_Homescreen-1-300x146@2x.png)

Closure

Thus, we hope this article has provided valuable insights into Unlocking Rewards: A Comprehensive Guide to American Express Cash Back Calendars. We appreciate your attention to our article. See you in our next article!